Of the 1% Disclosed, $3 Million of Harvard’s Endowment is Invested in the Prison-Industrial Complex

On Thursday April 18th, Harvard President Lawrence Bacow stated to two organizers with the Harvard Prison Divestment Campaign that the University’s endowment holds roughly $18,000 worth of investments in companies connected to the prison-industrial complex.

Bacow’s statement is significant for a number of reasons. First, it marks the first time that any Harvard president publicly admitted that Harvard is invested in prisons at all. Second, Bacow remained steadfast in his opposition to divestment of even such a minuscule amount. This is an institution whose yearly budget is $4.5 billion, an amount greater than the state budget of Delaware. $18,000 is too small to even be considered pocket change for an institution like Harvard. But lastly and most importantly, our research shows that Bacow’s statement is either: 1) a categorical lie, 2) an unintentional but still demonstrable lie, or 3) a reference to some fund(s) held within the 96% of the university’s endowment that is shrouded in secrecy.

The remainder of this post will share specific details of how we, the Harvard Prison Divestment Campaign, know that the university’s investments into the prison-industrial complex total at the very least close to $3 million, a number that in all likelihood barely scratches the surface of the university’s actual holdings. We will first explain how we determine which companies meet the criteria for the prison-industrial complex before outlining our research process into the endowment to make connections with the named companies.

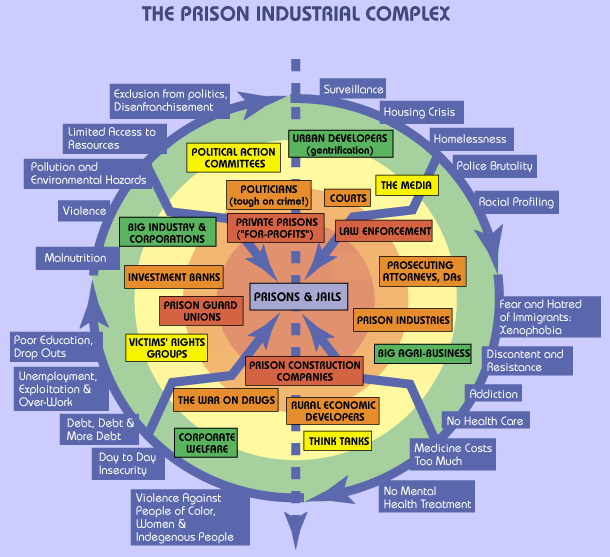

The Prison-Industrial Complex

Despite popular, if not willful, misunderstanding, the term prison-industrial complex does not refer only to private prison companies like CoreCivic or GEO Group. Rather, the term prison-industrial complex, as defined by the grassroots organization Critical Resistance, highlights:

the overlapping interests of government and industry that use surveillance, policing, and imprisonment as solutions to economic, social and political problems.

Another helpful way to visualize the prison-industrial complex comes courtesy of an illustration from The Corrections Documentary Project:

Applying this understanding of the prison-industrial complex, we then identified, read, and fact-checked a range of publications listing specific companies whose business models rely heavily on human caging, control, and confinement. Below are the top sources we used to identify our list of target companies:

- Investigate, maintained by the American Friends Service Committee

- The Prison Industrial Complex: Mapping Private Sector Players, published by Worth Rises

- U.S. For-Profit Privatized Correctional Services, compiled by Prison Legal News

- Prison Labor in the United States: An Investor Perspective, published by NorthStar Asset Management

- Police Brutality Bonds: How Wall Street Profits from Police Violence, published by the Action Center on Race & the Economy (ACRE)

- The Banks That Finance Private Prison Companies, published by In The Public Interest

- For Better or For Profit: How the Bail Bonding Industry Stands in the Way of Fair and Effective Pretrial Justice, published by the Justice Policy Institute

- Who’s Behind ICE? The Tech and Data Companies Fueling Deportations, published jointly by Mijente, the National Immigration Project, and the Immigrant Defense Project

From the beginning, our campaign has sought to sever the endowment’s ties with more than just private prison operators. The published research reveals that companies across several other industries also profit from human caging, including but not limited to banks, analytics & surveillance companies, bail bonds insurers, telecommunications conglomerates, and weapons manufacturers. The number of corporations reflected in the above reports exceeds 3,500, which we then narrowed to focus only on the 5-10 companies in each industry with the deepest levels of complicity in systems of human caging.

Thus far, our research has yielded an evolving list of roughly 100 companies that profit immensely from the incarceration, confinement, and control of black, brown, indigenous, and immigrant people. The Harvard endowment is connected to at least 50 of these companies.

The Harvard Endowment

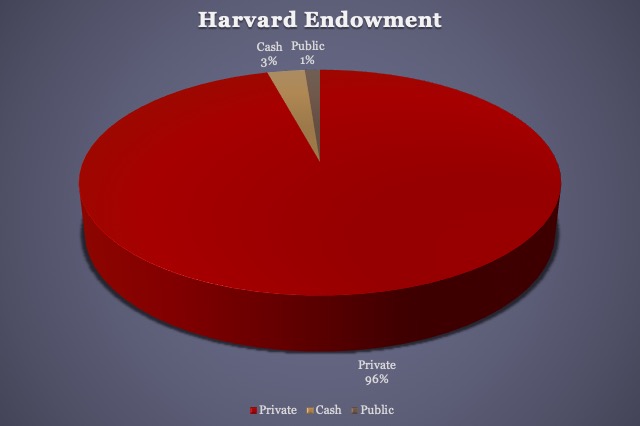

To understand how the Harvard endowment is connected to these core companies of the prison-industrial complex requires a basic understanding of what an endowment is. According to its most recent report, the Harvard Management Company (HMC)–which is the non-profit organization responsible for managing the university’s endowment–stated that the endowment was valued at $39.2 billion as of June 30, 2018. You may hear or read on occasion that Harvard has ‘$40 billion in the bank.’ That’s actually untrue. The 2018 HMC annual report states as much: just 3% of that $39.2 billion, or roughly $1.2 billion, is held in cash.

The remaining $38 billion is invested into a range of financial entities. In general, these entities fall into two large categories: public (or exchangeable) holdings and private (generally non-exchangeable) holdings. To the best of our estimation using the most recent available data, we approximate that Harvard invests just $474.6 million (1%) of the endowment into public holdings and a staggering $37.5 billion (96%) into private holdings. See the chart below.

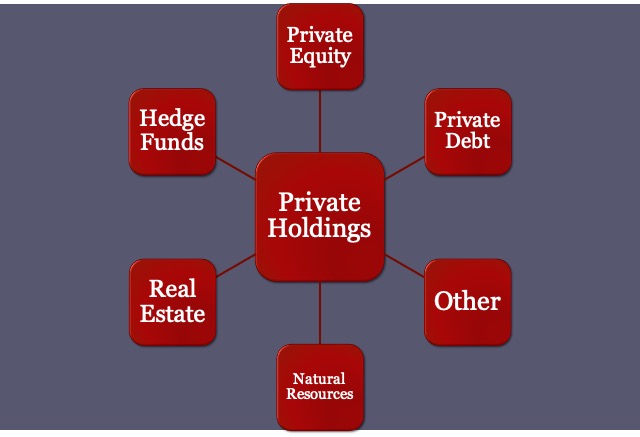

We have more questions than answers about the 96% of the Harvard endowment invested in private holdings; these asset classes are relatively unregulated (compared to public assets) and frustratingly obscure. Our frustration is shared by Kat Taylor, a Harvard alumnus and former member of the Harvard Board of Overseers who resigned her seat last year in part to protest the endowment’s opacity. Thus, the first and most basic demand we have of the university is to disclose the specifications of its private portfolio. While the 2018 HMC annual report provides percentage allocations into these various asset classes, specific firms and funds remain undisclosed.

Opponents to disclosure often argue that Harvard’s status as a private university should shield it from such a demand. However, this opposition occludes two salient factors. First, Harvard and every other technically private, non-profit institution of higher education in the U.S. receive billions of dollars in public funding every year. The Internal Revenue Service classifies Harvard and its private peers as “public charities” for a reason: they receive direct taxpayer subsidies from local, state, and federal governments. Each and every U.S. taxpayer helps to fund Harvard. Second, Harvard’s particularly troublesome history with its endowment demands transparency. In its past, the university has invested in and benefited directly from the transatlantic slave trade, South African apartheid, and the crisis in Darfur. If the university wants to hold the trust of its faculty, staff, students, donors, and neighbors, then it must reproduce its receipts.

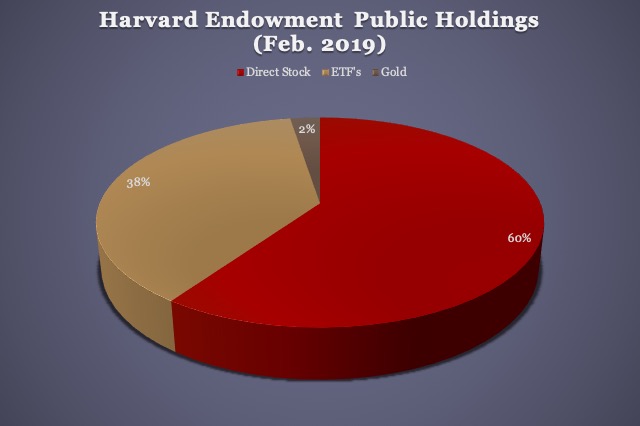

What the university does disclose about its endowment, in accordance with federal law, is its public holdings, which are also known as securities. The connections we have identified between the endowment and the prison-industrial complex so far come exclusively from the university’s public portfolio holdings, which, as noted above, amount only to $474.6 million, or 1%, of the endowment. The public portfolio, which is disclosed via quarterly filings with the U.S. Securities and Exchange Commission, is available through the commission’s EDGAR database. As reflected in the most recent filing from February 8, 2019, the endowment’s public portfolio includes a mixture of direct stock investments into a few companies (e.g., Facebook, Microsoft, Google, and Apple), investments in exchange-traded funds (ETF’s), and investments in gold.

While the university asserts that it does not hold direct stock in prison companies, this statement is technically true, but misleading. Harvard only directly invests in eight corporations: the aforementioned four tech giants plus Aduro Biotech, Magenta Therapeutics, Neon Therapeutics, and T. Rowe Price. Combined, Harvard pours $283 million into these companies, roughly 60% of its public portfolio. It devotes 2% of the portfolio to gold shares, apportioning the remaining $178 million (or 38%) to exchange-traded funds (ETFs).

Several of Harvard’s ETF investments include companies profiting from the prison-industrial complex. Our calculations show this figure to approximate close to $3 million. Here’s how we know.

An ETF is essentially a bundle of different stocks, bonds, and other securities that a customer (like HMC) can buy as a single security, rather than investing in hundreds or thousands of individual companies. To find the specific companies that comprise the ETFs in which Harvard is invested, we first retrieved the ETFs’ unique numbers (known as CUSIPs) from the HMC’s most recent SEC filing of FORM 13F. After pasting the CUSIP numbers into a search engine, we navigated directly to each respective fund’s website and downloaded the spreadsheet (usually a .csv file) that lists the fund’s portfolio. The ETF portfolios are important because they typically indicate, among other types of data, not only the names of companies but also the weight (in percentage) allocated to each company from the fund, a number that can and does vary slightly from day-to-day. We followed these steps for all of the ETFs in Harvard’s holdings, capturing spreadsheets and the weight allocations as of February 19, 2019.

After combining all of these ETF portfolio data into one large data set, we simply cross-checked this listing against the targeted list of roughly 100 prison-industrial complex companies referenced above. Where positive matches were found, we added the company to a separate spreadsheet and indicated the fund in which it is indexed, its weight, Harvard’s monetary investment in the fund, and, finally, Harvard’s rough investment into the company itself. The result is the spreadsheet embedded below.

President Bacow’s peculiar reference to Harvard investing only $18,000 in private prisons (which again, are only a small part of the prison-industrial complex) simply does not fit the facts. Based on our calculations from the mere 1% of the endowment that is publicly disclosed, Harvard has invested approximately $3 million in some of the companies most complicit in the prison-industrial complex.

We have explicitly outlined our calculations and the reasoning behind them. Thus we invite, but do not demand, President Bacow and the Harvard Management Company to do the same.

Leave a comment